Mwananchi Credit Forced to Refund Sh1.92M to Customer After Competition Authority Ruling

Editor’s note :The story was originally published by https://kenyainsights.com/

Micro lender Mwananchi Credit Limited has been forced to pay a customer Sh1.92 million for a loan overcharge that she was slapped with.

The Competition Authority of Kenya (CAK) received a complaint from a customer who took a Sh9 million loan. According to the complaint, the facility was to be repaid over 24 months at an interest rate of 10%, and monthly repayment of Ksh. 825,000 and attached her land as collateral.

The complainant opted for an early repayment. She expected to repay Ksh. 11,700,000 but she was allegedly overcharged by Ksh.1, 923,750 and therefore paid Ksh. 13,500,000.

The Authority investigated the alleged conduct pursuant to Section 31 of the Act, as read together with Section70(A), and sent a notice of investigations to Mwananchi for probable violations of Sections 55 (a)(ii) and 56 (1), which relate to false or misleading representations and unconscionable conduct. The unconscionable conduct was assessed against the requirements of Section 56 (2) (a) and (d) of the Act.

Following the investigations, the micro lender was found to have been in contravention. Mwananchi refunded the complainant Ksh. 1,923,750.

Another customer, Benson Ojwang also lodged a complaint with the authority, he claimed Mwananchi inflated his loan balance without his knowledge and despite his efforts to have it corrected, it was in futility.

Following CAK’s intervention, this was rectified.

Going after Mwananchi

The revelations gives hopes and has opened a way for many aggrieved customers who don’t know how to seek help in cases of loans inflation and other terrible encounters that the micro lender has been accused of before.

Mwananchi Credit Limited were put in the spot in 2020 after they allegedly declined to release a client’s car plus his logbook months after clearing his loan.

The client accused the company of taking advantage of the covid-19 pandemic situation to charge higher interest rates and penalties on a loan he defaulted after the country was put on lockdown.

In late 2019, Mr. Dennis Otieno took a buy off loan of Ksh. 1, 030, 562 which was used to purchase a Toyota Hiace Matatu.

Up until when President Kenyatta ceased all inter county movement, Mr. Otieno was comfortably paying his monthly installments of about 84,000/.

The countrywide lockdown was a blow to him as his Matatu business grounded and to make matters worse he lost his job.

In April he was not able to repay the month’s installment and things got from bad to worse as Mwananchi quickly repossessed his vehicle which was plying the Nairobi Kisii route.

For a man whose sources of income had dried up, the financial institution did not come to a reasonable agreement with Mr. Otieno and between the months of May and September, he managed to secure another loan from Rafiki Bank which he used to offset the 1 million loan which had now accrued to Ksh. 1.7 million.

After negotiating with Mwananchi Credit, Otieno was given until August 27th to clear his loan upon which his vehicle and logbook would be returned to him.

In a guarantee letter dated 24th August 2020, Mwananchi Credit, unconditionally and irrevocably agreed to release Mr. Otieno’s vehicle and logbook within 48 hours after Rafiki Bank paid the total 1.7 million buy off from them.

“We shall within 48 hours of the payment of the outstanding loan….commence the transfer process of the logbook from our name to that of Rafiki Microfinance Limited” read part of the undertaking guarantee letter.

In the guarantee letter, Mwananchi Credit through their advocates promised to refund the money within 48 hours if they fail to complete the transfer to Rafiki Bank’s name.

On the 9th of September, Rafiki Bank bought off Otieno’s loan and repaid Mwananchi in full, one week after the agreed period of payment.

Related Content:How Italian Tycoon Alessandro Torriani Tricked And Conned Local Land Owner To Buy The 62 Acres Of Land On Funzi Island With Sh500,000 Only

Otieno’s troubles escalated when upon going to claim his repossessed vehicle and logbook he was asked to pay another Ksh. 502,000.

The company has been taking Otieno in circles demanding that he repays the money. The complaint said that he had no idea where the money came from yet Rafiki Bank already bought off the loan in totality.

Otieno claimed that Mwananchi Credit Limited Director, one Mr. Dennis Mombo said that the penalty was for failing to repay the loan on time, after Rafiki Bank delayed by one week and half in disbursing the money.

Otieno further said that he was astounded when he stumbled upon an advertisement in Daily Nation’s copy of November 16th, where his Matatu had been put up for Auction on behalf of Mwananchi Credit Limited.

Otieno is now rapaying Rafiki Bank’s 1.7 million loan, a feat he says is burdensome since his source of income has been held and put up for sale.

Reached for comment, Mwananchi Credit refuted Otieno’s claims saying that he still owed them 502,000 shillings.

The complaints on the facility are countless and harsh.

In 2018, Annerlisa Muigai, the heiress to the Keroche Breweries multi-billion empire implicated Dennis Mombo the CEO in an alleged fraud. Anerlisa came out to deny claims she defaulted of a Ksh19.9 million loan, which she borrowed from the Nairobi businessman.

In a post on her social media platforms, Annerlisa said Ben Kangangi (the man who she borrowed money), who used to sell cars, colluded with Dennis Mombo Mwangeka to have her provide security for the disputed loan, which he claims was to be used to finance a government tender for the supply of electric cables.

Annerlisa says she gave Kangangi Ksh 7 million and asked him to borrow the rest from elsewhere and that is when the drama ensued. She adds that Kangangi and Mwangeka could also be seen drinking together despite the former’s earlier assertion that they did not know each other. The matter ended up in court with Dennis suing Anerlisa for defamation.

Benji Ndolo was tracked down by auctioneers and was humiliated at Nairobi CBD as his vehicle was towed away over unserviced loans.

Initially trading as Mwananchi Microlink Ltd from 15th April 2010, it officially changed names to Mwananchi Credit Limited on 10th January 2012.

And more accusations

Mwananchi Credit Limited, is fighting off multiple suits by clients who accuse the firm of seeking to dispose of their property after loading high interest and penalty charges that put repayment out of their reach.

A borrower Harrogate Limited and its director Alice Muthoni Thuo have taken to court Mwananchi Credit and are accusing them of interest loan infringement for a credit facility they had applied back in 2020.

It was a Ksh.50 million credit facility that has since accrued to Ksh.177.5 million in less than two years.

In a sworn affidavit, the two complainants say the defendant only disbursed Ksh.43,121,980 and not Ksh.50 million as agreed.

According to the initial agreement, the borrowers were to pay an interest of Ksh.6.12 million in five months and pay the remaining balance of interest and principal on the sixth month.

The facility was attracting an interest of five percent and a loan processing fee of Ksh.2.5 million, loan application fee of Ksh.500,000 being one percent of the total loan.

They were also charged Ksh.300 for loan papers and another Ksh.300 for Credit Reference Bureau (CRB) check fees.

They contend that Mwananchi Credit only disbursed Ksh.30 million in two instalments, Sh15 million to Harrogate Limited on February 25, 2020 and a similar amount to Alice Muthoni Thuo’s account three days alter.

According to the court documents, the micro-finance was reluctant to channel the remaining balance of Sh20 million despite numerous follow ups.

Two months after getting the first tranche of the loan, the applicants received an email from the lender compelling the first plaintiff to pay Sh3.3 million interest failing which a penalty of five percent every week will apply.

They argue that rules had changed midway. On June 28 the same year, the lender informed the borrowers that the amount due was Ksh.63.26 million, implying the Ksh.30 million facility had accrued interest of over Ksh.32 million in just four months.

The affidavit shows that to avoid penalty as threatened by the defendant, Harrogate Limited paid an interest of Ksh.3.3 million on March 28, 2020 upon which the lender disbursed Ksh.5,624,980 as the second tranche of the loan.

On July 2, 2020, the defendant requested the first applicant to execute the letter of Sh7 million and insisted that the amount be utilised towards payment of the first drawdown or apply a five percent weekly penalty,

This prompted the applicants to seek clarification from the lender on August 17 via email.

The microlender did not respond but instead proceeded to have the first plaintiff execute the second Letter of Offer on September 9 for an aggregate loan amount of Ksh.76,604,792.

The same micro-lender has been accused accused by a section of borrowers for changing rules midway with an intention to property offered as security. It has naturally overtime denied the claims.

In 2018, a borrower, George Washington Mallan Omondi, fought to stop Mwananchi Credit Limited from disposing of his Lavington home after he defaulted on repaying Sh6.5 million borrowed in May 2017.

Mr Omondi was shocked that the loan accrued Sh14 million interest by March 2018. Mwananchi Credit was going to dispose of his house, valued at Sh200 million, at a throwaway price.

Mr Omondi said he borrowed Sh8.9 million to be repaid in six months but received only Sh6.5 million and was told the difference covers interest.

This is just one of the many suits the firm is fighting off. Wilfred Omondi Opiyo borrowed Sh2 million to be repaid in three months with interest of Sh661,998. He used his property in Kajiado as collateral.

He says he repaid two instalments but due to financial difficulties defaulted on the third.

Mwananchi Credit Limited moved to sell his property to recover Sh4.2 million, which it said was the outstanding amount.

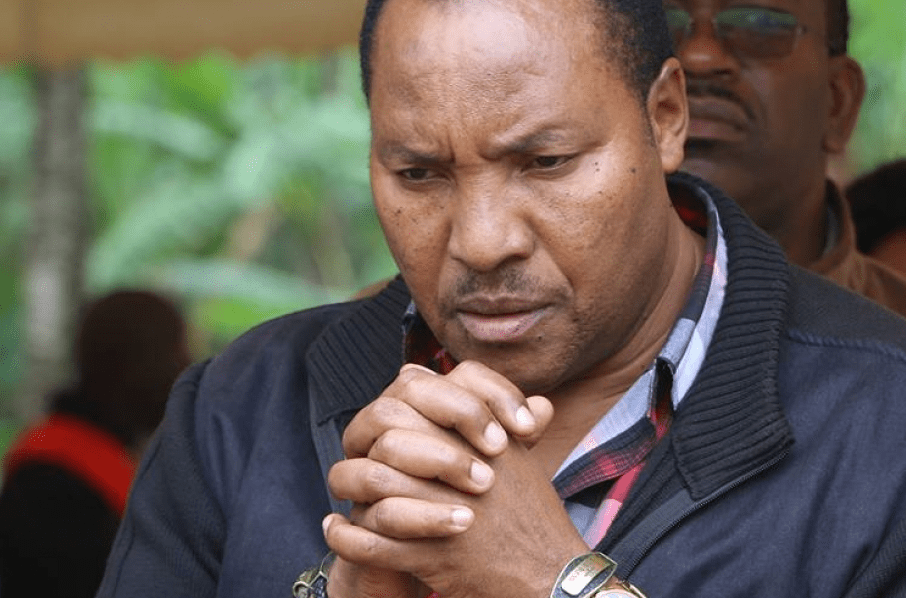

Kiambu ex-governor Ferdinand Waititu.

Its not just ordinary people that have had to deal with Mwananchi Credit’s wrath, Former Kiambu Governor Ferdinand Waititu has had a run with the micro lender and had to seek court’s cushion in April this year when they came for him.

Waititu had allegedly defaulted on a Sh10 million car loan he took from Mwananchi Credit Limited in January 2020.

The micro-finance company was now seeking to auction the ex-county boss’s motor vehicles to get back their money.

Waititu had used two logbooks to secure the loan.

The former governor moved to court seeking to stop the planned auction, claiming he is currently financially constrained after he lost his job as Kiambu county boss in January 2020 over graft and abuse of office allegations.

Related Content:EACC Blocks Transfer Of Governor Obado’s Nairobi Home Bought With Stolen Funds By His Proxy Jared Kwaga Of The Sh2B County Scam

Waititu in his application filed at the Kiambu Law Courts, said that he was unable to raise the money because there is no regular monthly income credited to his bank account.

“I am seeking more time to sell some of my property and use the money to offset the loan. Alternatively, the lender should allow me to settle the loan in installments,” Waititu pleaded.

Mwananchi Credit Limited seized the two vehicles Waititu used as collateral to secure the loan.

Remedy

Following up with the micro lender when one feel shortchanged can be tiring and hell. The intervention by the competition authority can be a relief.

The Consumer Protection Department enforces Parts VI (Section 55 to 70) of the Act. The core function of the Department is to investigate complaints relating to false or misleading representations, unconscionable conduct as well as supply of unsafe, defective and unsuitable goods.

Over the last months, CAK has ramped up its enforcement activities with respect to incidences of abuse of power (ABP).

Now, Consumers can complain directly to the Authority through the post, Email, Telephone call or walking into the Authority’s offices. The consumer is required to fill in a consumer complaint form and provide all the relevant information concerning the complaint. So should you fall a victim of Mwananchi or any other micro lender, lodge a complaint with CAK or alternatively CBK anti banking fraud unit.

The story credit: https://kenyainsights.com/competition-authority-forces-mwananchi-credit-to-refund-customer-sh1-92m-for-a-loan-overcharge/