Retail Sector Records 0.1% Increase In Rental Yields

Cytonn Real Estate, the development affiliate of Cytonn Investments, has released their Kenya Retail Sector Report-2021. The report analyses the performance of the retail sector in Kenya based on rental rates, occupancies and rental yields, thereby identifying the investment opportunities and outlook for the sector.

According to the report, in 2021, the Kenyan retail sector registered increased market activities evidenced by the aggressive expansion by major local and international retailers as opposed to 2020 which was marked with lockdowns leading to retailers scaling down their businesses to cushion themselves against the pandemic.

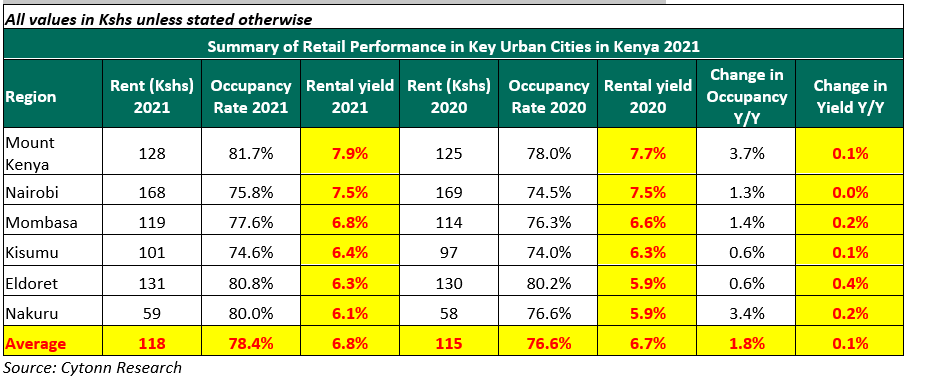

In terms of performance, the Kenyan retail sector performance recorded 0.1% points increase in the average rental yields to 6.8%, from 6.7% in 2020.

Average occupancy rates and rental rates realized an increase of 1.8% points and 2.2%, respectively, to 78.4% and Kshs 118 per SQFT in 2021 from 76.6% and Kshs 115 per SQFT in 2020, respectively, mainly attributed to an improved business environment as well as local and international retailers such as Giordano, Carrefour, Optica Limited and Naivas aggressively taking up new retail spaces as well as spaces previously occupied by troubled retailers such as Tuskys thus cushioning the overall performance of the retail market.

The performance of the key urban centres in Kenya is as summarized below:

In the NMA, the retail market recorded average rental yields of 7.5% similar to 2020, with occupancy rates coming in at 75.8%, a 0.6% points increase from the 75.2% realized in 2020 due to the increased demand for spaces. Rental rates however continued to remain subdued at Kshs 168 per SQFT in 2021, 0.2% lower than Kshs 169 per SQFT recorded in 2020 as landlords continue to give incentives such as lowering rents to attract and retain tenants.

Mount Kenya offers the best investment opportunity to retail space developers with the average rental yields and occupancy rates at 7.9% and 81.7%, respectively, 1.1% and 3.3% points higher than market average of 6.8% and 78.4%. This can be attributed to improved average rental rates which came in at Kshs 128 per SQFT from Kshs 125 per SQFT in 2020, and increased demand for retail spaces as a result of the region being undersupplied by 0.7 mn per SQFT.

For NMA, opportunity lies in Westlands and Karen which were the best performing nodes with average rental yields of 9.7% and 9.4%, respectively which were 2.2% and 1.9% points higher than the market average of 7.5%.

This can mainly be attributed to higher average rental and occupancy rates that they fetch at Ksh 209 per SQFT and 80.4%, respectively, against the market average of Kshs 168 per SQFT and 75.8%, respectively, adequate amenities and infrastructure, and the undersupply of retail stores in Karen thus driving higher demand for the available ones.

The table below summarizes metrics that have a possible impact on the retail sector, that is the retail space supply, performance, retail space demand, and concluding with the market opportunity/outlook in the sector